Nanonets uses advanced algorithms to detect and highlight discrepancies instantly. This feature allows finance teams to quickly pinpoint the root causes of discrepancies, facilitating faster and more accurate reconciliation. Say goodbye to manual errors, time-consuming tasks, and financial discrepancies. With Nanonets, you can automate your vendor reconciliation workflow, ensuring accuracy, efficiency, and peace of mind. So, for example, if you spend money with a company credit card but forget to declare it in the general ledger, this could lead to inaccuracies between credit/debit card reconciliation and bank reconciliation.

You’re our first priority.Every time.

Transaction errors include duplicate recording of transactions in the detailed subsidiary journal that’s a sub-ledger or recording an asset as an expense. Capital accounts activity includes par value of the common stock, paid-in capital, and treasury share transactions. Compare income tax liabilities to the general ledger account and adjust for any identifiable differences that need recording via journal entry. These steps can vary depending on what accounts you are reconciling, but the underlying premise is always the same – compare your ending balance against supporting documentation and make any adjustments as needed.

Intercompany Reconciliations

Accountants compare the general ledger balance for accounts payable with underlying subsidiary journals. GAAP (generally accepted accounting principles) requires accrual accounting to record accounts payable and other liabilities in the correct accounting period. Prepaid assets are prepaid expenses that are capitalized as an asset when paid in cash. Prepaids are recognized gradually as an expense, using a monthly allocation with a journal entry to reduce the prepaid asset balance and record the expense on the income statement.

Check Outgoing Funds

Errors in logging payments correctly, duplicates, or missing entries may lead to incorrect reporting. If you have your own business, account reconciliation is vital as it’ll help you ensure your financial records are accurate and up to date. As the name implies, this reconciliation is done to match the business records with those supplied by the vendor or supplier of the business. This type of reconciliation is done to match the balances of Accounts Payable by checking the amounts recorded against each transaction with the records or statements supplied by the vendor. Reconciliation is an important process for businesses because it helps them make sure that their transactions are recorded correctly and accurately. The process allows businesses to gain confidence that they have recorded the correct data within their accounts.

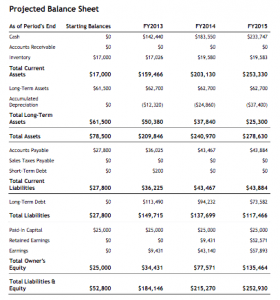

Companies need to reconcile their accounts to prevent balance sheet errors, check for possible fraud, and avoid adverse opinions from auditors. Companies generally perform balance sheet reconciliations each month, after the books are closed for the prior month. This type of account reconciliation involves reviewing all balance sheet accounts to make sure that transactions were appropriately booked into the correct general ledger account. It may be necessary to adjust some journal entries if they were booked incorrectly. Intercompany transactions include adjusting entries for profit elimination relating to general ledger accounts like intercompany revenues, accounts receivable, fixed assets, inventory, accounts payable, and cost of sales.

Bank Reconciliation

Enhance your month-end closing and easily integrate your existing accounting or ERP software without disrupting your current finance workflow. Bid farewell to the headaches of bank statement discrepancies and transaction errors. The purpose of account reconciliation is to ensure that the money coming in and going out (debits and credits) always matches up. Using accounting software will make it much easier to reconcile your balance sheet accounts regularly.

This is done by comparing debit card receipts or check copies with a person’s bank statements. Sometimes a deposit or a payment recorded in your accounting software isn’t on the monthly bank statement. When paper checks were the main way that vendors and employees https://www.simple-accounting.org/ were paid, this was a much bigger problem. But today, nearly instantaneous communication of financial transactions means the delay between the money leaving one account and reaching another one may be measured in minutes or hours, not days or weeks.

For instance, reconciling a general ledger requires you to obtain necessary details, such as the ending balance of the general ledger account, which is the balance as of the accounting period end date. One other use of account reconciliation is a company’s need to maintain an internal control environment that complies with Section 404 of the Sarbanes-Oxley Act. With the accounting activities of companies majorly done by humans, there is no writing off human error. Account reconciliation, therefore, serves as a chance for companies to get rid of this human error from their entire accounting process.

Businesses that follow a risk-based approach to reconciliation will reconcile certain accounts more frequently than others, based on their greater likelihood of error. To choose the right option for you, think about the present and future versions of your business — your accounting software should be able to support both. Right now, check that it’s within your budget and is compatible with your point-of-sale and/or payroll software, as well as your accountant’s system.

For her first job, she credits $500 in revenue and debits the same amount for accounts receivable. Accounting software helps you track how money moves in and out of your small business. The best accounting software makes it easy to keep a detailed financial record so that you’re ready come tax season. It also includes tools for streamlining accounting tasks, like the invoice process, and gaining insight into your business’s financial health. The first is to review your business’s financial records and compare them with original documents, including invoices, receipts, and statements. While all of these types of account reconciliation are used to ensure accurate financial records, some are more useful in highlighting illegal activity.

- You would need to justify, explain, or correct any differences or discrepancies.

- When you compare the two, you can look for any discrepancies in cash flow for a certain time frame.

- It’s a statistical approach that helps identify whether discrepancies between accounts result from human error or potential theft.

- During reconciliation, you should compare the transactions recorded in an internal record-keeping account against an external monthly statement from sources such as banks and credit card companies.

Businesses and individuals may reconcile their records daily, monthly, quarterly, or annually. A company, ABC Manufacturing, purchases raw materials from a vendor, XYZ Supplies. At the end of the month, the accounts payable team of ABC Manufacturing undertakes the activity of vendor reconciliation to ensure all transactions are accurately recorded and there are no discrepancies. So, for example, you would compare your business’s financial records, such as cash account records, with data from a third party, such as bank statements.

The process is particularly valuable for companies that offer credit options to their customers. They can then look for errors in the accounting records for customers and correct these when necessary. In accounting, reconciliation refers to a process a business uses to ensure that 2 sets of accounting records are correct. Another way of performing a reconciliation is via the account conversion method. Here, records such as receipts or canceled checks are simply compared with the entries in the general ledger, in a manner similar to personal accounting reconciliations. Sage 50 Accounting, unlike some of its competitors, offers inventory management and job costing features at all plan levels.

For instance, when a company conducts a sale, it debits either cash or accounts receivable on its bank statement balance sheet. The very basis of double-entry accounting is itself an internal reconciliation. Transactions that impact accumulated depreciation and depreciation expenses a company’s bottom line — net income — are split between accounts on the balance sheet and the income statement. This means that journal entries that hit balance sheet accounts can cause something on the income statement to shift.

Using a schedule of general ledger accounts, analyze capital accounts by transaction for any additions or subtractions. The spreadsheet should include beginning balance, additions, subtractions, and any adjustments required for recording https://www.business-accounting.net/securities-and-exchange-commission-2/ to agree with the general ledger ending balances for capital accounts. Reconcile beginning balance, list and add new transactions, list and subtract payments or other reductions, and compute the ending balance for the period.